The Cost of Owning a Lake Keowee Home: What Buyers Should Consider

The Cost of Owning a Lake Keowee Home: What Buyers Should Consider

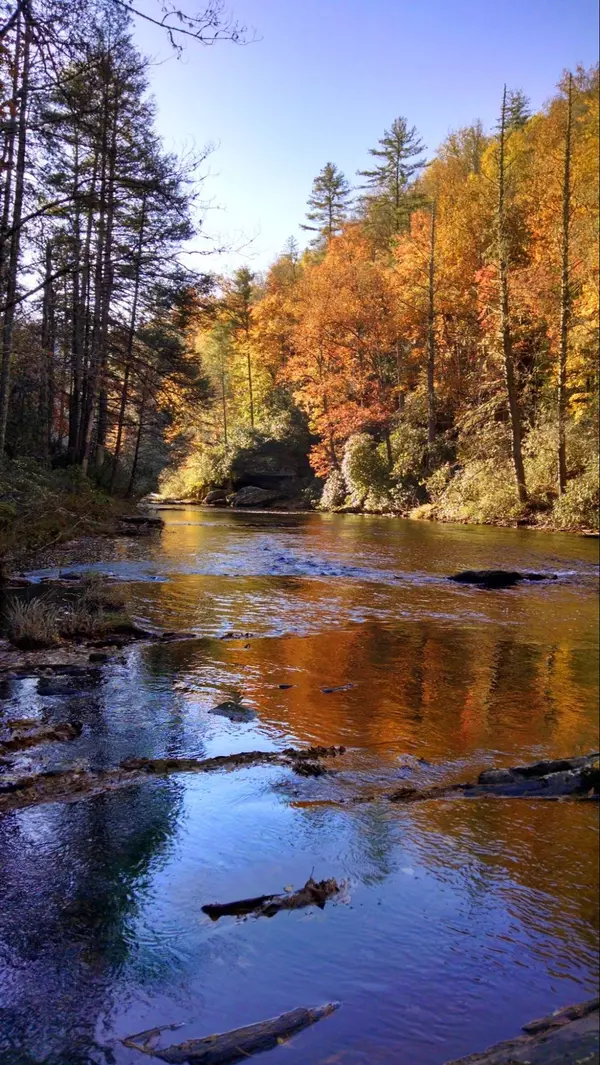

Owning a lakefront property at Lake Keowee is a dream come true for many—a place to unwind, enjoy nature, and make memories with family and friends. However, owning a lakefront home involves unique costs that go beyond the typical expenses of homeownership. To make the most of your Lake Keowee investment, it’s essential to understand all the associated costs. Here’s a comprehensive guide to what buyers should consider when budgeting for a Lake Keowee home.

1. Property Purchase Price

The initial purchase price of a lakefront property on Lake Keowee will vary based on factors such as location, lot size, water access, and home amenities.

- Location on the Lake: Properties with direct lake access or premium views may come with a higher price tag, while homes slightly off the water or with limited lake views can be more affordable.

- Community and Amenities: Homes within established communities, like The Reserve at Lake Keowee or Keowee Key, often come with additional amenities (such as golf courses, clubhouses, and fitness centers) and, subsequently, a higher price.

- Lot Size and Water Frontage: The amount of waterfront footage and the size of the lot will also influence the purchase price, as more waterfront space often translates to higher property value.

2. Property Taxes

South Carolina’s property taxes are relatively low compared to many other states, which is an appealing benefit for Lake Keowee homeowners.

- Low South Carolina Property Taxes: The state has some of the lowest property taxes in the country, which is great news for lakefront buyers. However, lakefront homes are still appraised at higher values due to their desirable location.

- Local Property Tax Variations: Property tax rates can vary slightly based on the county and municipality where the property is located. Properties in more developed or premium areas may have slightly higher tax rates.

- Additional Considerations for Vacation or Second Homes: South Carolina taxes vacation homes and second homes at a slightly higher rate than primary residences, so buyers should consider this when calculating their property tax costs.

3. Homeowners Association (HOA) Fees

Most lakefront communities around Lake Keowee, such as Keowee Key and The Cliffs, are managed by homeowners associations (HOAs) that maintain common areas, community amenities, and enforce neighborhood rules.

- HOA Dues: HOA fees can range significantly depending on the community, covering costs such as landscaping, pool maintenance, security, and community events.

- Access to Amenities: Higher HOA fees often correlate with communities that offer more amenities, like golf courses, marinas, and fitness centers, which can enhance the value and enjoyment of the property.

- Special Assessments: Occasionally, HOAs may implement special assessments to cover large projects, such as road repairs or marina updates. These are typically rare but important to budget for.

4. Maintenance Costs

Lakefront homes often require more maintenance due to their proximity to water and exposure to natural elements, so it’s essential to consider upkeep costs.

- Dock and Shoreline Maintenance: If your property includes a dock, it may require regular maintenance to keep it safe and functional. This can include repairs, painting, and checks for any weather-related wear.

- Exterior Home Maintenance: Exposure to lake moisture and UV rays can lead to faster wear on home exteriors, windows, and doors. Regular maintenance, like painting, pressure washing, and sealing, helps protect the home.

- Landscaping and Erosion Control: Lakefront properties may have unique landscaping needs, such as erosion control measures for the shoreline. Some communities include landscaping in HOA fees, but individual homeowners may still have landscaping upkeep.

5. Utilities and Services

Utilities and services at Lake Keowee may differ slightly from what you’re used to, especially if the home is located in a more rural or secluded area.

- Water and Sewage: Some lakefront properties have access to municipal water and sewage, while others rely on well water and septic systems. Septic maintenance should be budgeted for if your property uses one.

- Electricity and Internet: Due to the rural setting, some areas may have higher electricity costs or limited internet options. Research utility providers and confirm costs if high-speed internet is essential.

- Waste Disposal: Waste disposal services may be handled differently in lakefront communities, so it’s worth inquiring whether garbage and recycling pickup are included in HOA fees or if separate providers are needed.

6. Insurance Costs

Insurance for a lakefront property can be more costly than standard homeowner’s insurance, as lakefront homes are more exposed to natural elements and potential weather-related risks.

- Homeowners Insurance: Standard homeowners insurance covers most issues, but waterfront homes typically have higher premiums due to increased exposure to weather damage.

- Flood Insurance: Although Lake Keowee itself is managed to avoid extreme flooding, certain properties may still benefit from flood insurance, especially in low-lying areas. Confirm if your home is in a flood-prone area and consider flood insurance accordingly.

- Liability Insurance for Docks and Boats: If your property includes a dock, additional liability insurance may be advisable to cover any potential accidents involving guests or watercraft.

7. Boat Ownership and Lake Recreation Costs

Lake Keowee’s pristine water makes it perfect for boating and water activities, but these can also come with additional expenses.

- Boat Purchases and Storage: If you plan to purchase a boat, consider the initial cost and ongoing storage or docking fees. Some lakefront communities have boat storage options, while others may require offsite storage.

- Boat Permits and Registration: South Carolina requires permits and registration for certain watercraft. Be sure to check the state’s requirements for your boat type and add these fees to your budget.

- Equipment for Water Activities: Kayaks, paddleboards, fishing gear, and other equipment all add up, so consider your recreational needs and the associated costs of these activities.

8. Security and Property Management

If your Lake Keowee property is a second home or vacation rental, having a reliable property management or security plan is essential.

- Property Management Fees: Hiring a property management company to maintain and monitor your home while you’re away can provide peace of mind but will add to your monthly expenses.

- Vacation Rental Management: If you plan to rent out your Lake Keowee home, vacation rental management fees may include marketing, booking, and cleaning services. This can be an added cost but may also provide extra income to offset ownership expenses.

- < strong>Security Systems: A security system with remote monitoring can be a worthwhile investment, especially if the property is not occupied year-round.

9. Potential Renovations or Upgrades

Many lakefront properties are purchased with the intent to customize or update features, so it’s helpful to plan for potential upgrades.

- Dock Improvements: If the property doesn’t already have a dock or you want to expand, consider the cost of installation and permits.

- Outdoor Living Spaces: Adding a fire pit, outdoor kitchen, or patio enhances the lakefront experience and adds value to the home.

- Energy Efficiency Upgrades: Consider investing in energy-efficient windows, doors, and appliances, which can help reduce utility costs over time and withstand the lakefront climate better.

Conclusion

Owning a lakefront home on Lake Keowee is an investment in lifestyle, relaxation, and natural beauty. By understanding the various costs involved—from property taxes and insurance to maintenance and recreational expenses—you’ll be better prepared to make the most of your Lake Keowee property. With thoughtful budgeting and planning, you can enjoy a peaceful lakefront lifestyle and create lasting memories on one of South Carolina’s most beautiful lakes.

Ready to find your ideal Lake Keowee home? Contact Me today to start your search and discover the perfect lakefront property to fit your lifestyle and budget.

Categories

Recent Posts

GET MORE INFORMATION